Legislative Updates

OREIA's main purpose is to advocate for legislative change for the benefit of its members. OREIA employs a Legislative Director, Dan Acton, and a professional lobbying firm, Governmental Policy Group, to actively monitor and engage at the state level.

Current Legislative Update 11/2025- The legislature will likely recess at Thanksgiving and not be back until February 2026.

Visit the Ohio Legislature website to search any bill's status and full language.

Speaker of the House: Matt Huffman

Leadership includes Representatives Manning, Plummer, John, Bird, McClain, Demetriou, Santucci and Williams.

Senate President: Rob McColley President.

Leadership includes Senators Reineke, Gavarone, and Lang.

Sign up for our Real Estate Advocacy List and customize the alerts you want! We need your help in our grassroots efforts to stop costly legislation.

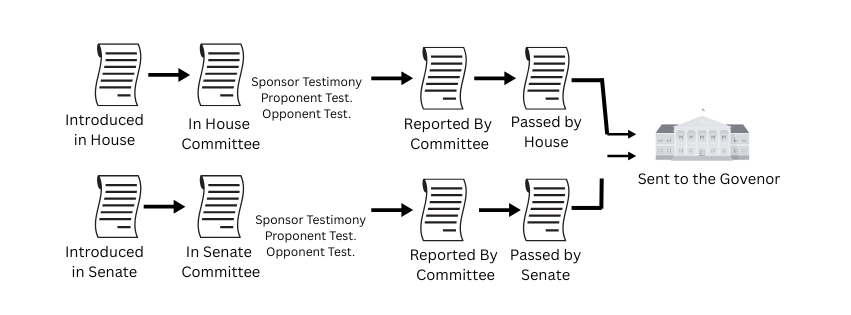

How a Bill Moves

HB92/SB118 Municipal Liens "Water Bill": Changes the rules for municipalities to collect on delinquent utility services to force action against those who contracted with the service before holding property owners responsible. A substitute bill was introduced and accepted by the committee. It simplifies the bill to state that NO utility may place a lien of any amount on any property for collection. This is a much better situation for our members and OREIA is excited about this possibility. We are working hard to get this version voted out of committee and onto the floors. It will hopefully have a hearing before the recess.

SB28 High Volume Landlord Tax: This ridiculous bill was reintroduced by Senator Blessing in an effort to curb the influence and ownership of institutional investors (they currently own btw 1-3% of SFH, not much influence). If enacted, it would charge those who own more than 50 properties in any one county $2,000 PER month PER house! This bill has lost momentum through OREIA's continued efforts to educate legislators as to the devastation this bill would bring to the industry.

SB22 Property Tax Credit: Offering a property tax credit to certain homeowners and renters if their tax liability is greater than 5% of their income. This bill hasn't had any hearings but the idea is often included in property tax reform conversations.

SB155 Real Estate Wholesaling: At OREIA's urging, Sen. Brenner removed the licensure requirements and substituted a required disclosure to make sure all parties are aware of and agreeable to the full process of a wholesale transaction. It is not as plain language as OREIA suggested, but it is a reasonable solutions to address concerns about bad actors, while protecting wholesaling consumers and investors. SUCCESS!!! OREIA was able to get the disclosure language adjusted to better represent advice and not a mandate. The bill passed both chambers Unanimously and is awaiting the Governor's signature. We will send out details when the bill has been signed.

SB5 Anti-Squatter Bills: Look to make squatting a criminal offense able to be addressed directly by law enforcement instead of a civil matter requiring eviction court. OREIA fully supports these common sense bills to protect property owners and neighboring properties from criminal elements. Introduced to Senate committee and hearing proponent testimony. No additional movement since introduction. OREIA NEEDS squatting stories to help put a face on this legislation! Please contact us if you are willing to share your story.

Supply Side Housing: Aims to incentivize municipalities to adopt favorable policies to increase housing supply by offering funds to local governments when certain housing reforms are implemented. However, in order to generate the revenue needed to fund the bill, it would raise taxes on real estate investors by eliminating the 10% non-business tax credit on rental housing! Almost 780,000 properties would be affected! On top of that, those funds could be used for a list of options that include counterintuitive policies that frequently deter development. This exact bill has not been re-introduced.

SB 104 Short Term Rentals: Bill aims to pre-empt cities and townships from banning short term rentals, limit registration requirements and fees. The bill has been amended to include a clause that grandfather's in existing local STR rules. This can include any passed while the bill is still moving and up to 90 days after the Governor signs it. With this change, OREIA has moved their support to a neutral stance as we don't believe it does enough to protect STR operators and the industry.

OREIA members testified in opposition to SB 161- taxing authority only and no owner/operator protections.

SB 83 Revise Housing Laws: Senator Reynolds has proposed a number of housing changes in response to her committee's tour of the state last year. This version has eviction records being automatically sealed until a plaintiff has won the case. It offers legal representation to renters, talks about non-binding mediation and LLC disclosures. OREIA has spoken to Sen. Reynolds about our serious concerns and will continue to engage with her. Has had NO hearings this year.

HB69 Tax Deduction Changes: Allows taxpayers to deduct the full bonus depreciation in a single year and enhance expensing allowances. OREIA is very supportive of this bill and will provide direct testimony on it to help our members maximize their deductions and simplify their tax returns. Sponsor testimony only.

SB135 Speed up Foreclosure Process: Shortens the timing and notices needed in the foreclosure process, requires professional appraisers to determine value, making the second auction no minimum. OREIA is concerned these changes will bump lender's lien positions in estate sales, increase the costs to homeowners in the foreclosure process, make it harder for homeowners to catch up, increase tax foreclosures on relatively small amounts. Has had sponsor, proponent and opponent testimony in committee.

SB143 Prohibits Criminal checks on employee applicants: OREIA is concerned about members who hire property managers and service contractors who enter homes on a regular basis. The potential for theft, assault, or other criminal behavior is a concern. OREIA takes safety seriously and worries how this will impact residents. No hearings in Committee yet.

HB135 Source of Income Discrimination: Like the many city ordinances around the state, this bill misrepresents housing providers' reluctance in participating in the troublesome Housing Choice Voucher program with hateful behavior. OREIA is providing results of an informal poll that overwhelmingly shows the truth behind low participation rates and offer alternative strategies. Has only heard proponent testimony.

HB181 Right to Counsel: Providing attorneys for "destitute" eviction defendants with one child and under 250% of the federal poverty line. OREIA will remind legislators that the "uneven playing field" they like to site is a result of state law that requires LLCs to have lawyers in all court activity. OREIA will also suggest up stream, early intervention to prevent evictions rather than last minute delays. No hearings this year.

Find your legislators: House Districts by map Senate Districts by map